There's no deductible for services received at a UCMC. Your overall health is important to us, and the university offers a variety of benefits to help support your physical and mental health. University of Louisville offers four health plans through Anthem Blue Cross Blue Shield.

Both plans cover services such as preventive care, doctors' office visits, hospitalization and prescription drugs. However, there are important differences between them—both in your choice of providers and what you pay when you get care (your out-of-pocket costs). Anthem Blue Cross HMO. You choose a primary care physician —from a UC Medical Center or the Anthem Blue Cross HMO network—who coordinates all your care, including behavioral health. Except for emergencies, only care received from UCMC or Anthem HMO doctors and at HMO facilities is covered at the in-network level.There's no deductible. For most services, you pay a small copayment and the plan pays the rest. This plan combines traditional medical coverage with a Health Savings Account .

Under this plan, all covered services (except preventive services/prescriptions) are subject to the annual deductible. The deductible is a dollar amount of out-of-pocket costs you must pay each year before the plan will begin paying its share of your healthcare expenses. The nice thing about this plan is that you can pay for that deductible using the tax-free funds in your HSA. Once the deductible has been met, most in-network services are covered with a 20% coinsurance.

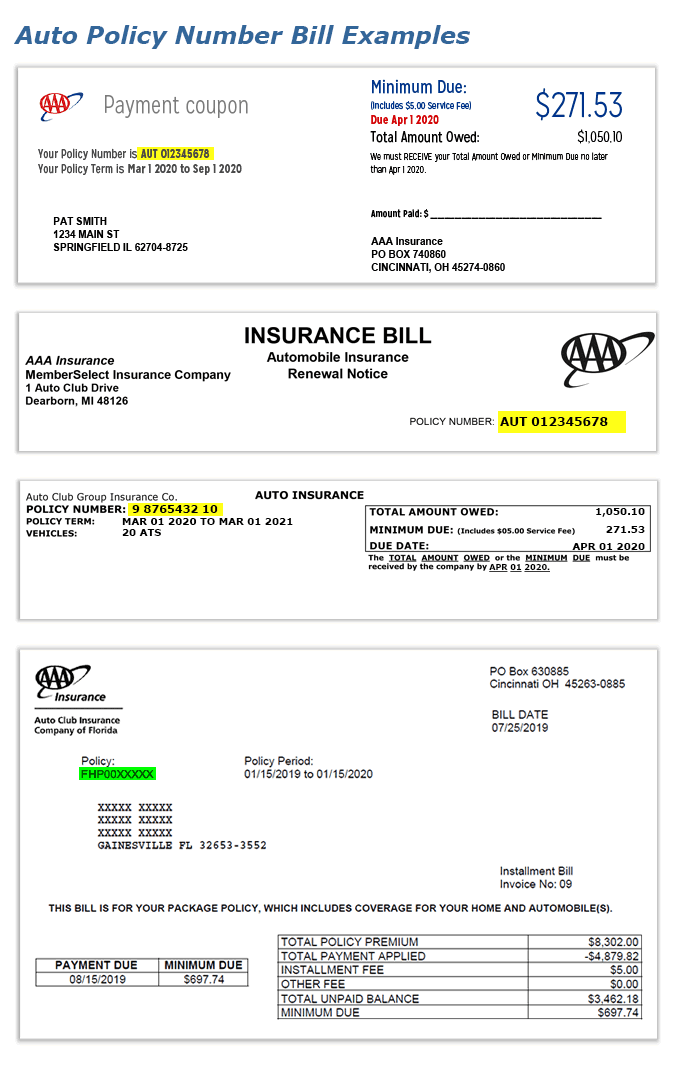

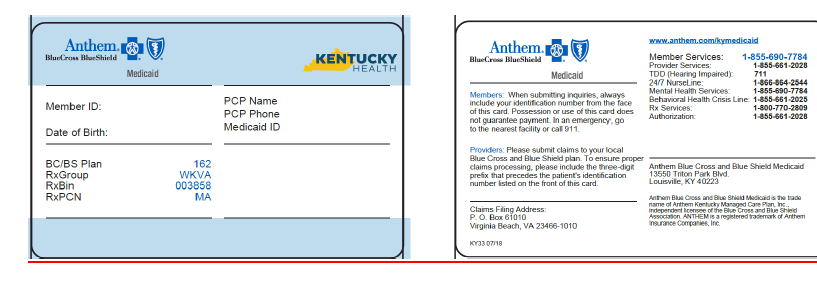

If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company . Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers. Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine. Some health insurance plans do not have co-pays, but many do. If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care.

If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network. If you're enrolled in family coverage, you must meet the family out-of-pocket maximum before Anthem will pay 100% of expenses. Because of its large network of providers, giving you many choices for where you get medical services. Anthem has a variety of health insurance plans available including options for individuals, families, Medicare, Medicaid and group insurance.

Beginning in 2013, Anthem Blue Cross became the behavioral health provider for Anthem HMO and PPO plans. If you are enrolled in one of these Anthem plans, you do not need a referral from your primary care physician in order to receive mental health services. Visit Anthem's website at /ca for a list of behavioral health providers.

You might see another list with 2 different percent amounts. PPO members have the option to see out-of-network providers. When you elect the Anthem PPO HDHP, you are also eligible to elect a Health Savings Account , a special tax-advantaged bank account to help cover your out-of-pocket healthcare costs. Your health insurance company might pay for some or all the cost of prescription medicines. If so, you might see an Rx symbol on your health insurance card. But not all cards have this symbol, even if your health insurance pays for prescriptions.

Sometimes, the Rx symbol has dollar or percent amounts next to it, showing what you or your insurance company will pay for prescriptions. The "coverage amount" tells you how much of your treatment costs the insurance company will pay. This information might be on the front of your insurance card. It is usually listed by percent, such as 10 percent, 25 percent, or 50 percent. You might see several percent amounts listed together. For example, if you see 4 different percent amounts, they could be for office visits, specialty care, urgent care, and emergency room care.

The health care network specified by your Anthem insurance policy will determine whether you have access to in-network providers in other states. When submitting an out-of-state claim, you must contact Anthem's customer service department because the process may be different. The deductible is the amount you must pay out-of-pocket before the plan will begin to pay benefits. The deductible applies to all covered services except preventive services/prescriptions.

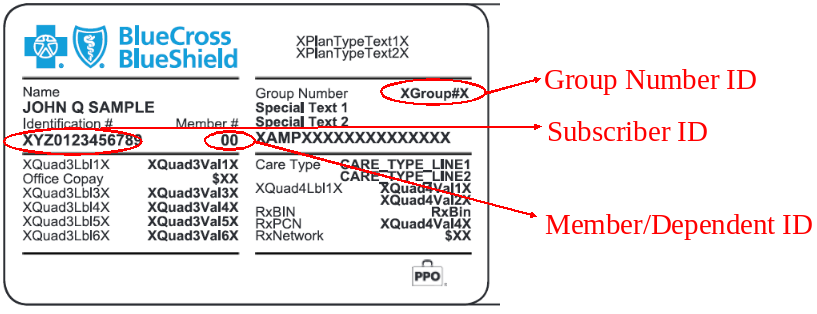

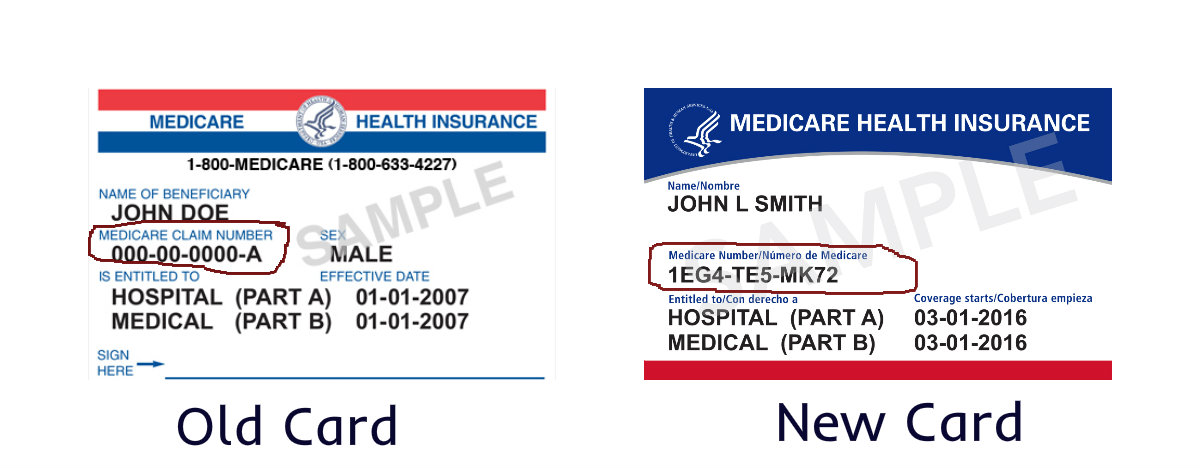

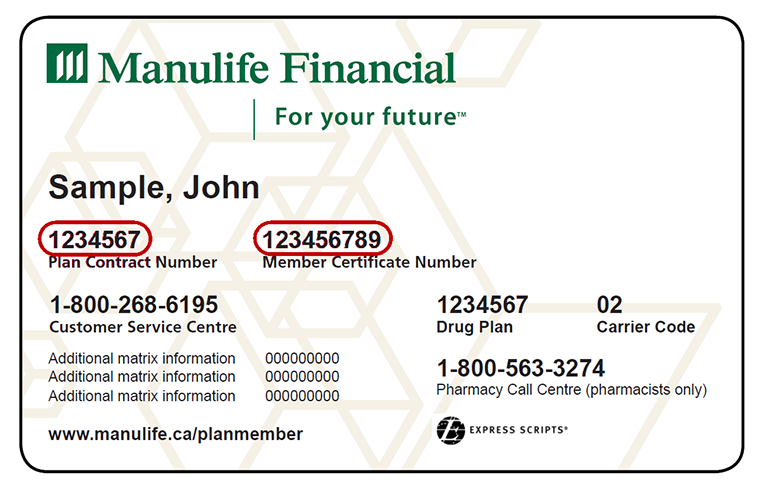

When one or more family members are covered, the family deductible must be met before services are covered for any member. If you have health insurance through work, your insurance card probably has a group plan number. The insurance company uses this number to identify your employer's health insurance policy. All health insurance cards should have a policy number.

Where Is The Policy Number On Anthem Insurance Card When you get a health insurance policy, that policy has a number. On your card, it is often marked "Policy ID" or "Policy #." The insurance company uses this number to keep track of your medical bills. If you forget or aren't sure what type of health insurance plan you have , you can find out on your BCBS ID card. If you have an HMO, your card may also list the physician or group you've selected for primary care. Determining whether a provider is in-network is an important part of choosing a primary care physician. Outpatient therapy is covered the same as a doctor's office visit.

When you get care from UC Medical Center or Anthem providers, once you meet your deductible, the plan pays most of the cost and you pay a portion . Anthem offers different types of health insurance, and plan types include HMO, PPO, EPO, prescription drug plans, vision, dental, short-term insurance and supplemental insurance. Policies are available for individuals and families. Seniors can sign up for Medicare plans, and those with low incomes can get Medicaid plans administered by Anthem.

The policies are usually popular in states where they're available, and the company has a large network of medical providers. Anthem's size has advantages such as being widely recognized and having the financial weight to provide members with good tech tools and helpful medical resources. There are also downsides including poor customer service and a lack of personalization.

Miami offers two health plan options through Anthem. You choose the plan that is best for you and your family. Option 1 is the Traditional PPO and option 2, the High Deductible Health Plan with a Health Savings Account. The back or bottom of your health insurance card usually has contact information for the insurance company, such as a phone number, address, and website.

This information is important when you need to check your benefits or get other information. For example, you might need to call to check your benefits for a certain treatment, send a letter to your insurance company, or find information on the website. Your digital ID card is always available on your mobile device or computer, and it works the same as the physical one. Use it when you visit the doctor or pay for services or care. When you pull it up, you can be confident you're providing your current health plan details. WithGinger, you have behavioral coaches, self-care resources, and video-based therapy and psychiatry services at your fingertips.

Plus you can get unlimited text-based support from behavioral health coaches anytime, anywhere through the Ginger app. Benefits elections must be made within 30 days of your start date or qualifying event. However, for any eligible dependent you elected to cover, you must submit documentation within 60 days of your benefits effective date to verify your dependent's eligibility. Verifying eligibility helps UofL to ensure compliance with the health plan provision, and manage the increasing costs of health care. Submit copies to the Human Resources office at 1980 Arthur Street.

You have choices for where you get non-emergency care. It's best to check your health care options before using the emergency room . Plus, when you visit in-network providers, you may pay less for care. Indiana University is an equal employment and affirmative action employer and a provider of ADA services.

All qualified applicants will receive consideration for employment based on individual qualifications. Department of Education Office for Civil Rights or the university Title IX Coordinator. See Indiana University's Notice of Non-Discrimination here which includes contact information.

To find out if a provider is "in network" contact your insurance company. The rate you pay for insurance will vary based on your personal details, where you live and the level of coverage you select. In 2022, individual health insurance plans are likely to be priced slightly higher, and the rate of increase varies by state. There are many plans to choose from, and members have access to useful resources and digital tools. Plus, monthly rates are usually a good value, and the company has a large network of providers. However, the company has a poor reputation for customer service, has repeatedly been fined for violating customer grievance practices, and has a high rate of claim denials.

We're expanding the types of care available via telehealth to better meet the needs of our members. Any medically necessary service covered under a member's health plan can now be performed via telehealth when appropriate, and offered by your doctor. We're making mental health care options more available to more members in more ways than ever before with remote therapy visits, self-guided programs, and wellness offerings. Take the first step and visit our Mental Health Resource Center. If you get your insurance through your employer or buy it on your own, we now support telehealth visits for these plans.

You can now have virtual visits with providers in our networks who offer this service to help you manage your health without leaving your home. Coinsurance is the percent of a covered healthcare service you pay after you have paid your deductible. For example, if your coinsurance is 20%, you pay 20% of the cost and the plan will pay the other 80%. Every health insurance card should have the patient's name on it.

If you have insurance through someone else, such as a parent, you might see that person's name on the card instead. The card might also include other information, such as your home address, but this depends on the insurance company. It's your identification that says, "I am a Blue Cross NC member." The back of your card has several important phone numbers to use when you need help. You'll need to show it every time you visit an emergency room, urgent care center or health care provider. Keep it in a safe, easily accessible place like your wallet. Your card contains key information about your health insurance coverage that is required when you need care or pick up a prescription at the pharmacy.

Keeping your card in a secure location will also help protect you from medical identity theft. Our phones, keys, driver's licenses and credit cards are kept at our fingertips at all times. Those items are unique to each of us, and provide access to the things we need.

When it comes to healthcare services, that item is your Blue Cross Blue Shield ID card. Discover a range of resources about our health care plans including sales, marketing, training and enrollment tools to help you support your clients. Anthem has a complex business structure of subsidiaries, and it's not always easy to decipher Anthem versus Blue Cross Blue Shield. The names of Anthem health insurance plans can change based on what state you're in, and some Anthem subsidiaries don't have Anthem in their name. Common examples include HMO Colorado, Empire plans in New York and Compcare plans in Wisconsin. As a mission-driven, not-for-profit company, we've been part of the community for over 75 years as the trusted insurer for individuals, families and employees in Tennessee.

So, you can expect excellent coverage, benefits and support for all your health care needs. The out-of-pocket maximum is the most you'll have to pay for covered services in a plan year. After you spend this amount on deductibles, copays, and coinsurance, the plan begins to pay 100% of the allowed amount for covered services.

This document is not intended to take the place of the care and attention of your personal physician or other professional medical services. Our aim is to promote active participation in your care and treatment by providing information and education. Questions about individual health concerns or specific treatment options should be discussed with your physician. If you are not sure whether your health insurance pays for prescriptions or how much it pays, call the number on your insurance card to find out. Your ID card says, "I am a Blue Cross NC member." You must show it every time you visit an emergency room, urgent care center or health care provider.

Your BCBS ID card has your member number, and in some cases, your employer group number. Your member number, also known as your identification number, is listed directly below your name. You'll need this information when receiving medical services at the doctor or pharmacy, or when calling customer service for assistance.

If your group number is available, you'll find it directly below your member number. And with Ginger, you and your dependents age 18 and older pay nothing for video based therapy and psychiatry services, up to 15 sessions per person, per year. Plus, you have unlimited access to coaching via text-based chats and self-care resources.

Video based therapy and psychiatry services are also covered, up to 15 sessions per person, per year. A blank suitcase symbol on a member's ID card indicates that the member's plan includes BlueCard benefits. The suitcase symbols are important when providing healthcare services to Blue Cross Blue Shield out-of-area patients.

If you're looking for medical, dental and vision plans for you and your employees, we have options to keep you covered from head to toe. Vision and vision wear coverage is provided through Anthem Blue View Vision. This coverage is included with your medical plan enrollment, but vision services have their own schedule of benefits and network separate from medical benefits. Blue Cross and Blue Shield of North Carolina does not discriminate on the basis of race, color, national origin, sex, age or disability in its health programs and activities.